|

Our Freedom |

||

|

and Excessive Government Control |

||

|

Seeking Veracity |

greytrek.com | |

|

|

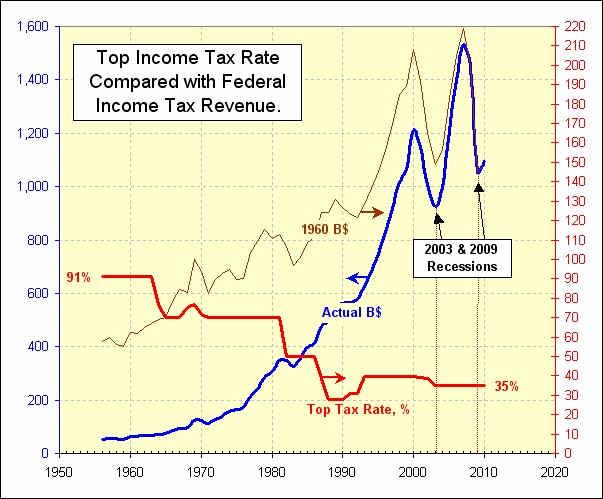

Democratic rhetoric in support of increasing high-end money makers' tax bracket is not justified. The name of the game is jobs and that requires a stimulated private sector. I analyzed data from sources on the internet and prepared a couple of charts. The first study was to see whether raising the highest tax bracket resulted in raising Federal Revenue. Well, it doesn't! The first chart shows this plot and if you look carefully at 2000 to 2003, the tax rate was decreased from 39.6% to 35% while the 2003 Recession showed a substantial reduction in Income Tax Revenue. So the Democrats might say that we lost revenue because of the bracket reduction. But if you look at the period after that, Revenue had a huge increase and then it plummeted down into the Recession of 2009. All this happened when the high tax rate was constant at 35%. So I have to conclude that the Democrats' suggestion to raise the rate to get more revenue is invalid. |

|

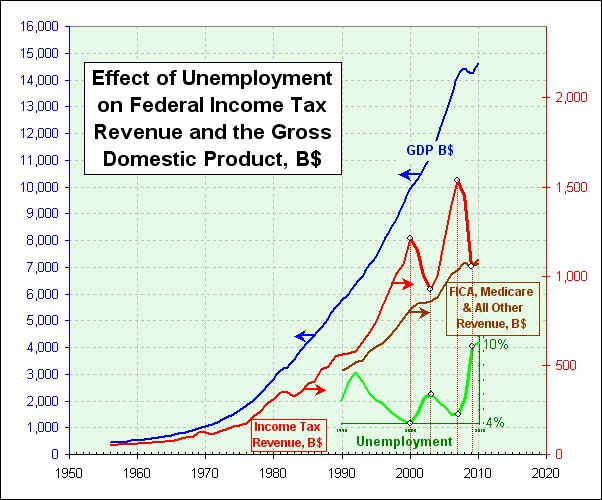

So what's the story regarding Revenue

anyway . . . Well, I next looked at the effect of Unemployment on

Revenue and the GDP . . . again using data that I got from the

internet. Well, I think we found it, that is . . . the

cause of the Revenue component of the United States fiscal problem.

This chart shows that when the income Tax Revenue took a big reduction,

the Unemployment went up from 4% to about 6% as in the

2000 to 2003 period. Likewise in the 2007 to 2009 period it does

the very same thing but this time the Unemployment soars to

about 10%. The GDP is retarded a little in the first period, but

really stalls and takes a "hiccup" in the second. All

other Revenue, including FICA, and Medicare, take slow-downs but

the real cause of Income Tax Revenue reduction is Unemployment.

So that's where the focus should be . . . to get the Revenue part of

the puzzle solved . . . and that means with small business incentives

and a United States fiscal policy aimed at helping the private sector

rather than taxing them and inflating size of the Federal government.

|

|